In the ever-evolving world of digital currencies, Bitcoin has emerged as a prominent player.

However, before diving into the realm of Bitcoin investment, it is crucial to equip oneself with essential knowledge.

This article aims to provide a concise yet informative overview of nine vital details to master before investing in Bitcoin.

From understanding wallets and exchanges to navigating market trends and legal aspects, this guide will equip readers with the necessary insights to make informed decisions in the dynamic Bitcoin landscape.

Bitcoin Wallets

Frequently, understanding the different types and functionalities of Bitcoin wallets is crucial for anyone looking to invest in the cryptocurrency.

One of the most secure options available is a bitcoin hardware wallet. These physical devices store the user's private keys offline, providing an extra layer of protection against online threats. By keeping the private keys offline, hardware wallets prevent hackers from accessing the funds.

Another popular option for secure storage is cold storage. This method involves storing the private keys on a device that is not connected to the internet, such as a computer that has never been online or a paper wallet. Cold storage offers increased security as it eliminates the risk of online attacks.

Both bitcoin hardware wallets and cold storage are highly recommended for those seeking to safeguard their investments in cryptocurrencies.

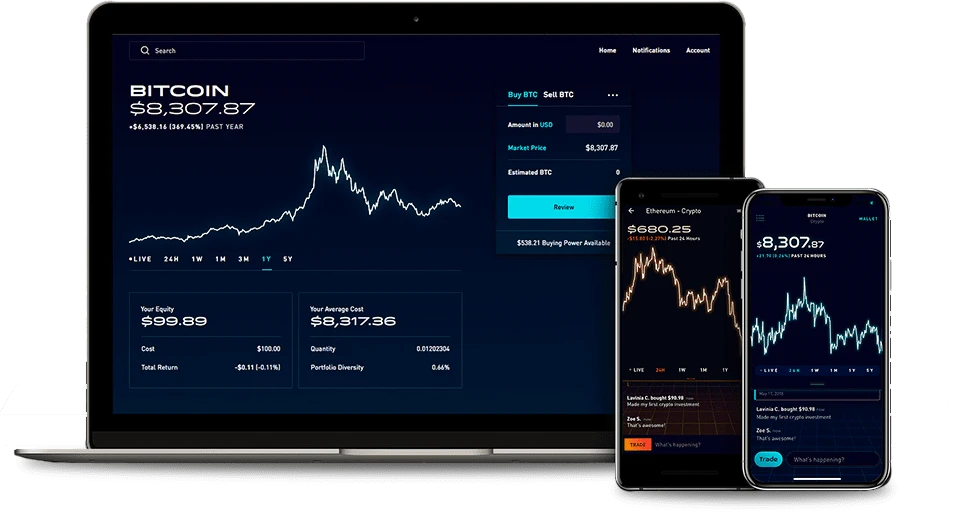

Bitcoin Exchanges

Many investors rely on Bitcoin exchanges to buy, sell, and trade the popular cryptocurrency. However, it is important to understand the intricacies of these exchanges before diving into the world of Bitcoin trading. Here are four key points to consider:

- Bitcoin regulations: Different countries have different regulations surrounding Bitcoin exchanges. It is crucial to familiarize yourself with the regulations in your jurisdiction to ensure compliance and minimize legal risks.

- Liquidity issues: Bitcoin exchanges can experience liquidity problems, especially during times of high demand or market volatility. This can lead to delays in executing trades or difficulty in finding buyers or sellers at desirable prices. Researching the liquidity of a particular exchange is essential to avoid potential issues.

- Security measures: Given the decentralized nature of Bitcoin, security is of utmost importance. Look for exchanges that prioritize robust security measures such as two-factor authentication and cold storage for funds.

- Reputation and reliability: Before choosing an exchange, consider its reputation and reliability. Look for exchanges with a solid track record, positive user reviews, and transparent policies.

Price Volatility

Price volatility is a key characteristic of Bitcoin that potential investors must understand.

The first point to consider is the inherent risk and uncertainty associated with the cryptocurrency market, where prices can fluctuate dramatically in a short period.

These market fluctuations are influenced by various factors, such as technological advancements, regulatory changes, and market sentiment.

Additionally, investor psychology plays a significant role in Bitcoin's price volatility as fear, greed, and speculation can drive sudden price movements.

Risk and Uncertainty

Investors in Bitcoin must navigate the challenges posed by its inherent risk and uncertainty, particularly in relation to its price volatility. To fully understand and mitigate these risks, it is crucial to consider the following:

- Investment strategies: Bitcoin's price volatility requires careful consideration of investment strategies. Long-term investors may opt for a buy-and-hold approach, while others may engage in active trading to capitalize on short-term price fluctuations.

- Regulatory challenges: Bitcoin operates in a decentralized and largely unregulated market, which presents regulatory challenges that can influence its price volatility. Changes in government regulations, such as restrictions or bans, can significantly impact the value of Bitcoin.

- Market sentiment: Bitcoin's price is highly influenced by market sentiment. News, events, and public perception can create sudden price swings, making it crucial to stay informed and monitor market sentiment.

- Technological advancements: Advancements in technology, such as scalability solutions and security measures, can impact Bitcoin's price volatility. Investors should stay updated on technological developments that may influence the market.

Navigating the risk and uncertainty associated with Bitcoin's price volatility requires careful analysis, strategic planning, and a thorough understanding of the factors that influence its value.

Market Fluctuations

To effectively navigate the challenges posed by Bitcoin's inherent risk and uncertainty, one must carefully analyze and understand the market fluctuations associated with its price volatility. Understanding market trends and analyzing price volatility are crucial in making informed investment decisions in the cryptocurrency world.

Bitcoin has a history of significant price swings, with its value often experiencing dramatic fluctuations in short periods. These fluctuations can be attributed to various factors such as market demand, investor sentiment, regulatory changes, and macroeconomic conditions.

Investor Psychology

Understanding the psychological factors influencing investment decisions is crucial when navigating the price volatility of Bitcoin. Investor psychology plays a significant role in shaping market trends and can have a profound impact on the value of cryptocurrencies. Here are four key insights into investor behavior and emotional decision making that are essential to grasp:

- Fear and Greed: Investors often make decisions based on emotions, such as fear of missing out (FOMO) or the desire for quick profits. These emotions can lead to irrational buying or selling, causing price fluctuations.

- Herd Mentality: Many investors tend to follow the crowd and base their decisions on the actions of others, rather than conducting thorough research. This behavior can create market bubbles or crashes.

- Loss Aversion: Investors are more sensitive to losses than gains, leading them to hold onto losing positions longer than necessary, hoping for a rebound.

- Confirmation Bias: Investors often seek information that supports their existing beliefs, ignoring contradictory evidence. This bias can prevent them from making rational decisions based on objective analysis.

Bitcoin Mining

In the realm of cryptocurrency, the process of Bitcoin mining plays a crucial role in verifying transactions and securing the network. Bitcoin mining involves using powerful computers to solve complex mathematical problems, which in turn validates and adds new transactions to the blockchain.

However, several factors influence the profitability of Bitcoin mining. One such factor is the cost of electricity, as mining requires a significant amount of energy. Additionally, the price of Bitcoin and the mining difficulty level also impact profitability.

It is also important to consider the regulations surrounding Bitcoin mining, as different countries have varying laws and policies in place. Some countries have embraced Bitcoin mining, while others have imposed restrictions or even banned it altogether.

Understanding these factors is essential for individuals considering Bitcoin mining as an investment opportunity.

Market Trends

One key aspect to consider when investing in Bitcoin is the analysis of market trends. Understanding the current market trends can provide valuable insights into the potential future direction of Bitcoin's price. Here are four important factors to consider:

- Institutional adoption: The increasing interest and participation of institutional investors in Bitcoin can have a significant impact on its price. Institutions bring credibility and stability to the market, which could lead to increased demand and price appreciation.

- Regulatory environment: The regulatory landscape surrounding Bitcoin is constantly evolving. Changes in regulations can influence investor sentiment and market dynamics. Keeping track of any new regulations or legal developments is crucial to understanding the potential impact on Bitcoin's value.

- Market sentiment: The overall sentiment of market participants can influence Bitcoin's price movements. Monitoring social media, news outlets, and investor sentiment indicators can provide valuable insights into the market sentiment towards Bitcoin.

- Trading volumes: Analyzing trading volumes can provide information about the level of interest and activity in the Bitcoin market. Higher trading volumes generally indicate increased liquidity and can be seen as a positive sign for Bitcoin's future prospects.

Security Measures

When considering investing in Bitcoin, it is crucial to prioritize robust security measures to safeguard your digital assets. As the popularity and value of Bitcoin continue to rise, so do the cybersecurity threats targeting this digital currency.

It is essential to understand the potential risks and take proactive steps to protect your investment. Encryption technology plays a vital role in securing Bitcoin transactions and wallets. By using strong encryption algorithms, you can ensure that your private keys and sensitive information remain secure.

Additionally, implementing multi-factor authentication, regularly updating your software, and using reputable cryptocurrency exchanges can further enhance the security of your Bitcoin investments.

Stay vigilant and informed about the latest cybersecurity threats to stay one step ahead and protect your digital wealth.

Legal Aspects

What are the legal considerations to keep in mind before investing in Bitcoin?

- Tax Regulations: Before investing in Bitcoin, it is crucial to understand the tax implications. Different countries have varying tax rules for cryptocurrencies, and failure to comply with these regulations can result in penalties and legal consequences.

- Money Laundering: Bitcoin's decentralized nature has raised concerns about its potential use for money laundering. It is important to be aware of the Anti-Money Laundering (AML) laws and regulations in your jurisdiction to ensure compliance and avoid involvement in illicit activities.

- Regulatory Environment: The legal status of Bitcoin varies across different countries. Some governments have embraced cryptocurrencies, while others have imposed restrictions or outright bans. Understanding the regulatory environment in your country can help you make informed investment decisions and avoid any legal issues.

- Investor Protection: Due to the volatile nature of Bitcoin, investors are vulnerable to scams and fraudulent schemes. Familiarize yourself with consumer protection laws and regulatory agencies that can offer assistance and support in case of any fraudulent activities.

Bitcoin Futures

Bitcoin futures offer investors a regulated and standardized way to trade the cryptocurrency in the financial markets. The regulation of Bitcoin futures provides a level of security and transparency that was previously lacking in the cryptocurrency market. This development has attracted institutional adoption, as large financial institutions are now able to participate in Bitcoin trading without the concerns of unregulated exchanges. The institutional adoption of Bitcoin futures has further legitimized the cryptocurrency as a viable investment option.

With the introduction of Bitcoin futures, regulatory implications have become a significant consideration for investors. It is important for investors to carefully evaluate the regulatory implications of Bitcoin futures and understand the potential risks involved. By doing so, they can make informed investment decisions and navigate the evolving landscape of cryptocurrency trading.

Peer-To-Peer Trading

Peer-to-peer trading is another method for investors to engage in the buying and selling of Bitcoin, offering a direct exchange between individuals without the need for intermediaries. This method has gained popularity due to its potential benefits, but it also comes with its own set of considerations. Here are four important points to understand about peer-to-peer trading:

- Privacy concerns: Peer-to-peer trading allows individuals to transact directly with each other, which can provide a certain level of privacy. However, it is essential to be cautious as scammers and fraudsters can take advantage of this anonymity.

- Liquidity issues: Unlike traditional exchanges, peer-to-peer trading may have lower liquidity levels, making it challenging to find suitable buyers or sellers at desired prices. This can result in delays and potentially impact the execution of trades.

- Security measures: When engaging in peer-to-peer trading, it is crucial to take appropriate security measures to protect your funds. Implementing strong passwords, using two-factor authentication, and utilizing encrypted communication channels are essential steps to ensure the safety of your transactions.

- Reputation and trust: Peer-to-peer trading heavily relies on reputation and trust between parties. Before engaging in any transactions, it is crucial to thoroughly research the counterparty, assess their reputation, and read reviews from other traders.

Understanding these aspects of peer-to-peer trading is vital for individuals who wish to participate in this method of Bitcoin exchange. While it offers certain advantages, it is equally important to be aware of the associated risks and take necessary precautions to ensure a secure and successful trading experience.

Frequently Asked Questions

How Can I Secure My Bitcoin Wallet From Potential Hacks or Theft?

To secure your bitcoin wallet from potential hacks or theft, it is essential to implement robust security measures such as using a strong password, enabling two-factor authentication, regularly updating your software, and storing your private keys offline in a secure location.

What Are the Advantages and Disadvantages of Mining Bitcoin?

Bitcoin mining has both advantages and disadvantages. On the positive side, it allows for the creation of new Bitcoins and verifies transactions. However, it requires significant computing power and energy consumption, making it less accessible for individuals. Efficient mining involves specialized hardware and knowledge of mining pools.

How Do Market Trends and External Factors Impact the Price of Bitcoin?

Market trends and external factors, such as government regulations and the involvement of institutional investors, play a significant role in influencing the price of Bitcoin. Understanding these dynamics is crucial for anyone considering investing in the cryptocurrency.

Are There Any Legal Restrictions or Regulations Surrounding the Use of Bitcoin in Different Countries?

Legal restrictions and regulations surrounding the use of Bitcoin vary across countries. It is crucial for potential investors to understand the regulatory environment in their jurisdiction to ensure compliance and mitigate any potential legal risks.

Can You Explain How Bitcoin Futures Work and How They Affect the Overall Bitcoin Market?

Bitcoin futures are financial contracts that allow investors to speculate on the future price of Bitcoin. They impact the overall Bitcoin market by providing a platform for price discovery and hedging strategies, influencing market sentiment and potentially increasing liquidity.

Conclusion

In conclusion, mastering the vital details of Bitcoin is crucial before investing in it. Understanding concepts such as:

- Bitcoin wallets

- Exchanges

- Price volatility

- Mining

- Market trends

- Security measures

- Legal aspects

- Futures

- Peer-to-peer trading

is essential for making informed investment decisions.

By acquiring this knowledge, investors can navigate the complex world of Bitcoin with objectivity and insight, mitigating potential risks and maximizing potential returns.

Business & FinanceHealth & MedicineTechnologyLifestyle & CultureScience & EnvironmentWorld NewsPrivacy PolicyTerms And Conditions

Business & FinanceHealth & MedicineTechnologyLifestyle & CultureScience & EnvironmentWorld NewsPrivacy PolicyTerms And Conditions